Residential buying guide

Our guide to buying residential property provides professional advice and information about the key factors to consider at the start of your search such as location, costs and contract negotiation, as well as information about the legal process involved.

1. Let us know you are looking for a property to buy

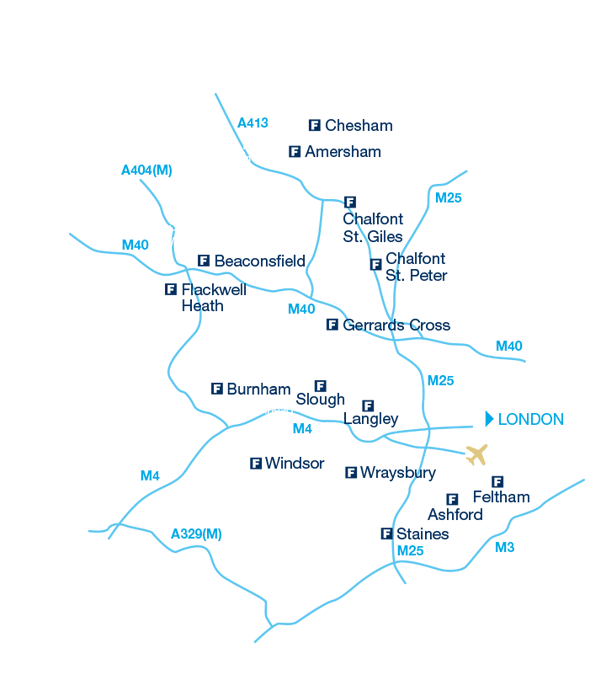

The first step to finding the right property is by letting us know what you are looking for. Contact or visit your nearest Frost office or register your property search requirements online with us - we will either contact you by phone or send you email updates when properties that fit your search criteria are available.

2. Start your property search

- View all our latest properties for sale

- Sign up for property alerts, to instantly receive emails about properties you are interested in

- Review our area guides

- If you are thinking about buying a property for investment purposes, view our online buy-to-let investment guide or download our step-by-step guide

3. Determine your budget

Buying a property is likely to be one of the largest transactions you ever make so it is important that you set your budget and get your calculations right from the start. If you are planning on using equity from the sale of an existing property towards the purchase of your new home, then we would always recommend that you acquire an accurate up-to-date market valuation from a local property expert. Please call your local Frost office to arrange a FREE market appraisal with no obligation.

4. Select the right mortgage

Whether you are a first time buyer looking for your first mortgage, re-mortgaging or securing a mortgage for an investment property, speaking to a mortgage expert is vital. To make the process easier, we can offer you mortgage advice through a select number of highly reputable Independent Mortgage Advisers with whom we have a long standing relationship and who can search 1,000s of mortgage deals to find the one that suits you best.

5. Viewing a property

Build a good picture of what a property is like to live in by visiting the property at different times of the day, taking note of which way the garden faces and what the parking arrangements are. It is important to also get clarification on what is and is not included in the sale price. Ask to see the Energy Performance Certificate (EPC), look up at roofs, look at windows, ask what type of heating it is and ask if there are any guarantees. If you wish to buy the property, it is advisable to arrange an independent survey to investigate any areas of concern.

After a viewing, please do provide feedback to your estate agent as it will help them.

6. Making an offer

You’ve found a property you want to buy - now what do you do? The next step is to reach an agreement with the seller on the price. The estate agent selling the property should be able to guide you through this process and help you decide whether or not to offer the asking price - be aware that many properties are sold at the asking price or above where there has been interest from lots of buyers.

7. Conveyancing

Once your offer is accepted by the seller, we can introduce you to one of our preferred solicitors who will act on your behalf throughout the conveyancing procedure. Conveyancing is the administrative and legal side of buying or selling a property, when solicitors prepare title deeds and confirm ownership.

8. Arrange a survey

If you require a mortgage then your bank will usually insist on a Mortgage Valuation to ensure the property is worth the loan value. However, you would not normally receive a copy of this report. You are therefore advised to seek a survey of your own. People ask us why they should spend extra on a survey before you commit to purchasing? Simple, it could save you thousands of pounds. The most commonly requested survey is the RICS HomeBuyers report, which is specifically designed to inform you about the condition of the property by highlighting the area of attention prior to purchasing. As a result can it can save substantial costs in repair and gives you ground for negotiating the asking price.

9. Exchange of contracts

Once your mortgage offer is secured and any necessary insurance cover in place, you will be ready to exchange contracts - this is the legally binding part of the process and when you hand over your deposit (usually 10% of the purchase price). Contracts are exchanged once you and the seller, along with both solicitors/conveyancers are satisfied that everything is in order and a date for completion is agreed. Both parties are then legally bound to go through with the transaction from this point.

10. Completion day

This is the day that the monies are transferred via the banking system and the day on which you will receive the keys to the property you have purchased and can move in. Congratulations!