Residential Property Investment Guide

An increasing number of people, disillusioned by investing in stocks and shares, are instead investing their capital in property. Our residential investment guide provides an important summary on what you need to consider and how to get started as an investor in bricks and mortar.

1. Find a residential property for investment

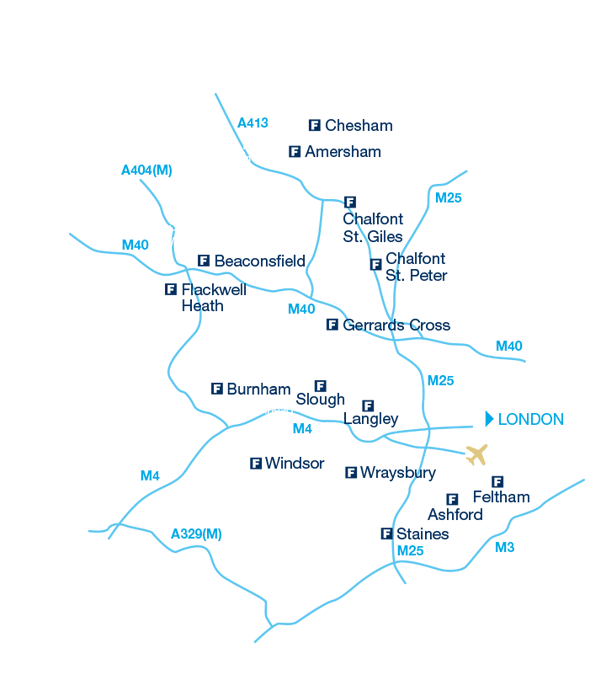

The Frost Partnership operates throughout Buckinghamshire, Berkshire and Middlesex. All of the areas we cover have excellent transport links via trains, the London underground and bus routes to London and all other major cities and towns, as well as Heathrow airport. The areas we operate in also offer a wide range of schools set within friendly communities, villages and towns that perfectly blend town and country living.

Investment properties come in all shapes and sizes. Old properties boast character, additional space and an opportunity for owners to develop or renovate, while New Homes provide investors with a brand new property that requires little maintenance and is ready for a tenant to move in. However, every tenant comes with a different list of must haves and their taste in style might be different to yours, so take the time to consider what your investment requirements are.

Find your next investment property. Search our property database by:

Generally speaking, New Homes do tend to be a much more popular property type for buy-to-let investors to purchase. Brand new appliances and state of the art technology are a magnet for tenants and save landlords hours of time handling property maintenance issues.

Read our guides

Buy-to-let guide, buying guide, lettings guide

Let us know you are looking

The first step to finding the right commercial property is by letting us know that you are looking - just contact your nearest Frost office and register your property requirements with us.

Each investor has their personal motivation for investing in property.

2. Financing your investment property

Investing in property is for many clients the best tangible asset investment available. The fluctuating stock markets over the last few years have unsettled a number of investors who have turned to property. However, the property market can be difficult to penetrate if you are a first time investor. Cautious lending from banks and building societies has created strict criteria from mortgage applicants.

- Mortgage advice

Our reputable, trusted independent mortgage advisors - will carefully assess your circumstances and help you find your target property price, helping you get the best possible mortgage. - Mortgage lenders

Lenders will expect your target rental income to exceed your monthly mortgage repayments by a certain percentage. - Buy-to-let mortgages

These generally require a deposit of 15-25% of the property’s market value and the mortgage lender will base your mortgage on the investment potential of your property, not your salary. - Help to Buy Scheme

Help to Buy is a temporary government-financing scheme designed to help you get on the property ladder. - Re- mortgage/release equity

Have you thought about releasing equity in your other existing property investments to fund a new purchase? Arrange a valuation of your property.

3. Managing your property portfolio

Managing tenants and property can be time consuming.

We offer three types of property management services designed to let landlords be as proactive or as removed from the commitment of being a full-time landlord as they wish. Our bespoke full management service is our most popular lettings service - it includes full maintenance services as well as services such as tenant sourcing, collecting rent, handling administration and assistance with more complex issues. Our full management service provides you with complete freedom.

Compare all three of our property management services.

4. Portfolio valuations

Our valuation team provides valuation services on flats, homes and estates, whether that’s one-off valuations or valuations of entire portfolios.

Our valuation experts possess years of local property knowledge and experience and are all qualified to provide a range of valuation and surveying services. Valuations are market-based, on-site inspections.

- Appraisals to ensure the property is priced correctly

- Mortgage or loan security valuations – to help refinance your property

- Asset valuations to ensure your property is structurally sound before you invest in it

Our valuations provide you with the right details to help you make an informed decision about your next investment acquisition or disposal. Arrange a valuation.

5. Growing your property portfolio

We work with investors, pension funds, developers, venture capitalists or high net worth individuals to source, evaluate and acquire property that complements the performance of their property portfolio.

Our goal is to achieve maximum investment performance from all your property investments. Here are just a few ways we can help you grow your portfolio:

- Property portfolio review

By taking a fresh look at your assets, we will find the ideal way to drive their performance, by identifying ways to increase their profitability such as rent reviews, lease expiries, negotiate to remove break lease, arrange disposals or acquisitions of new investment opportunities. - Tenants in situ

Investing in properties that offer tenants in situ will provide additional advantages such as being able to instantly calculate your finances and receive rental yield from day one. Contact The Frost Partnership for more information on properties with tenants in situ.

Growing a property portfolio can take a long time. The more time you allow your investments to mature, the more financially rewarding it can be in the long run. Contact your nearest Frost office to get started.

For more information about our residential investment services Contact your nearest Frost office