Blog

Selling your property in 2016?

Wednesday, December 9, 2015

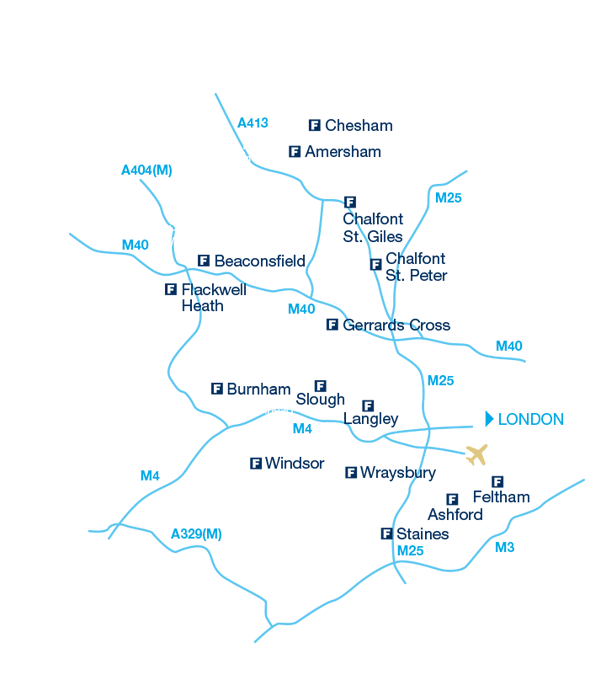

If you are thinking of selling your property in the New Year, why not get everything in place now and get a head start on the rest of the market? The demand for property in the south east is stronger than ever, and there’s a long list of buyers eager to move in the New Year. Last year on Christmas Day, Rightmove received over 1 million* visits to their site (twice that of the previous year) and over 2.2 million* visits on New Year’s Day, so now’s the time to get ready for January sales.

Firstly you’ll need an accurate market appraisal of your property taking into account current market conditions and key local factors such as parking, local amenities and transport links. You will also need to assess the competition and which sector of the market you’ll be targeting whether it’s young professionals, growing families or a retired couple.

It’s a good idea to appoint an agent you can really trust to provide you with your appraisal and advise you on marketing your property. They can then prepare property particulars with professional photographs and floorplans. Consider what fixtures and fittings you want to include in the sale and assemble any useful information you can give your agent such as council tax details, utility, buildings and contents insurance bills and service charges.

Deciding to sell your home may be the biggest decision you will ever make. By using the services of professionals with expert knowledge and legal protection, you minimise the risks involved, potentially saving time and money.

Once you know the current market value of your home you can assess your monthly finances and calculate what you can afford to buy. If you require finance, seek independent mortgage advice for suitable financial products that are currently available and also what the implications would be if interest rates rise. It's a good idea to calculate all of the costs involved in moving house, including mortgage arrangement fees, stamp duty and furniture removal costs, and factor these into your financial equations.

The financial and legal aspects of moving house have become increasingly complex in recent years so if you’re looking to sell in the New Year it’s a good idea to start the ball rolling now. We can put you in contact with trusted financial advisers and solicitors to offer detailed advice when you need it. For a FREE, no obligation market appraisal and advice on where to start just call your local Frost office.

* Source: Google Analytics December 2014 to January 2015. Please note you should seek appropriate independent mortgage advice from a qualified professional before making an offer to purchase a property. Interest rates may change over time and even if you select a fixed rate, the rate may be fixed only for a limited period. Many lenders charge fees in connection with arranging a mortgage which may be added to the loan increasing the amount you owe and must pay interest upon. Your home may be repossessed if you do not keep up mortgage repayments.