Blog

Forget Brexit – Flex it! Keep your property options open.

Monday, April 15, 2019

Since THE referendum in June 2016, many people in the UK, as well as those living abroad, have been deferring their decisions as to their next move property-wise. For most, buying a property is the single biggest financial investment that they will ever make and not a decision that can be reversed overnight if you make a mistake. With the average cost of moving exceeding £30,000 in some parts of Britain and over £10,000 across the UK on average, it’s worth looking for a home that is “future proof” or at least one that will see you through the next few years even if your circumstances change. So how can you remain flexible, keep your options open and your stress levels down when considering your property options?

Home ownership has become something of a “holy grail” in the UK over the years. “An Englishman’s home is his castle” and there’s a sense of prestige about property ownership and having the freedom to extend or redecorate, but renting can offer greater flexibility in many ways. It allows you to “try before you buy” if, for example, you want to find out whether an area meets your expectations before you commit to investing in a property. You could escape to the country only to find that the novelty of rural life wears off quickly and you miss the buzz of the city. If you’re renting a property, it’s not a problem, but if you’ve bought it could be a costly mistake.

Retirement is often viewed as a new start, the opportunity to try new things but, with a rising state pension age and increased life expectancy, retirement can now start later and last longer. Choice and freedom are key to the happiness of many retirees and downsizing whilst maintaining an asset as a legacy for children is often a priority. Renting offers the option to discover how far you can downsize in comfort and the chance to validate the notion of moving to the seaside for example, or simply be “closer to family”; all popular choices for retirees. Once property size and location have been established, it’s worth considering a development for residents as young as 55 with a range of health and leisure facilities and the benefits of added security. If there’s any concern about mobility in later years a bungalow, flat with lift, or a house with potential for a downstairs bedroom is ideal.

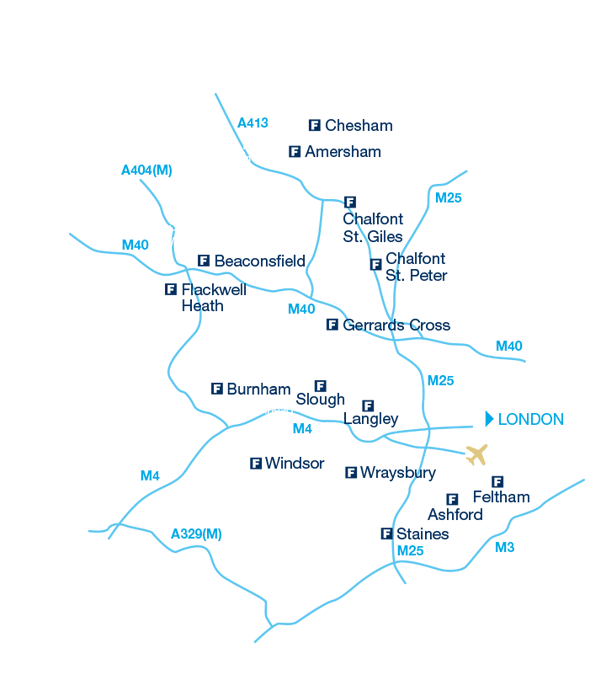

If you’re a commuter and are looking to keep your options open, renting allows you to test the options before putting down firmer roots and deciding to buy. If you’re buying a property, The Frost network area allows you to keep your options with multiple transport links. From Windsor for example there’s Great Western into Paddington, or South West Trains to Waterloo. Amersham offers both mainline and underground stations with a 33 minute journey to London Marylebone from its mainline railway station or 47 minutes on the Metropolitan line into Baker Street. There’s also easy access to the M25 and M40 and the A40 direct into central London.

Education is often a key factor in terms of property choice for families so it’s wise to think ahead and consider all the options if you have a young family. Within Berkshire and South Buckinghamshire, for example, there is a wide range of schooling options from state grammar to private schools allowing you to keep your options open. Whilst there are no guarantees to catchment areas remaining static in the future, there are certain areas which represent a safe bet for grammar school entrance although they are likely to command a premium.

If you are likely to move frequently for work but still want to get a foot on the property ladder, consider buying something that is a good rental proposition. Your local Frost office can advise you on which properties can potentially make a good buy to let investment and what income you can hope to achieve over extended periods even if you move overseas for work.

There’s a trend towards more people working from home, and if that’s likely to be the case for you, keep your options open by buying a property that has a spare room to convert, space to extend or add a garden office should you need it.

Whether for work or family reasons, you can future proof your requirements to some extent by looking for flexibility in the way you might use a property, ideally with the option to extend to suit changing personal needs. Many properties have untapped potential, and renovations can make a home more spacious as well as adding to its market value, providing works are done to a high standard. You could add a conservatory, convert your loft or even excavate a basement.

You may even be able to keep your options open by literally giving your property a whole new lease of life. If you’re thinking of moving from a property with a shortening lease, investigate the possibility of extending it. You could stay put AND add value to your property. It should be considered sooner rather than later as, once a lease term is less than 80 years, the cost of extending the lease increases significantly. By law, a leaseholder (tenant) now has the right to extend their lease once they have owned a property for two years. The right is to add 90 years on to what is left on the existing lease at a “peppercorn rent” (this means no ground rent is payable). The landlord is entitled to a premium for the lease extension and how this is calculated is set out in the relevant Act. For more information about your rights and the options/costs involved, please call our surveying department on 01494 680909 for some expert advice.

Whatever your property dilemmas this spring, talk to your local property expert at The Frost Partnership for some professional advice on ways to keep your property options open.