Blog

Buyer confidence remains high

Monday, July 24, 2023

Buyer confidence remains high with 73% confident that they will purchase in the next three months as long as the price is right, according to the latest OnTheMarket Property Sentiment Index. Jason Tebb, CEO of OnTheMarket, said buyer and seller sentiment was not shaken during May, despite interest rate rises and mortgage product availability and suggested that the softening of house prices in some areas was the reason for both buyer and seller confidence. “There’s more choice of stock than has been the case for a while and if you can afford to buy, now is a great time to make a move. Although some buyers will inevitably be worried about higher mortgage rates, there seems to be a growing realisation of the need to adapt to a new, elevated level of pricing, in place of the unsustainable rock-bottom rates of the past.”

He advises both sellers and agents to price correctly from the outset and to carefully consider timing. “If you want to move by a certain date, ask your agent about various pricing structures and how being sensitive on price can speed up the time it takes to find a buyer. It looks as though the next three months might well be tougher than originally thought and there may be a negative knock-on impact on transaction levels. However, there is no reason why sellers who take advice from an experienced local agent, and price realistically under their guidance cannot still achieve a timely sale.”

Despite recent mortgage interest rate increases, Rightmove’s latest market snapshot also suggests the immediate impact on activity has been limited with most movers determined to carry on if they can still afford it. “Average new seller asking prices, the first and leading indicator of new trends in the market, have dropped slightly this month, signalling that the belated spring price bounce has quickly turned into an earlier than usual summer slowdown. We expect asking prices to edge down during the second half of the year, which is the normal seasonal pattern, and current trends suggest that our original forecast of a 2% annual drop in asking prices at the end of 2023 is still valid. Agents report that new sellers are sitting in two camps – those who still have overoptimistic price expectations following the buoyant pandemic market, and those who have adapted to the new conditions and are coming to market with a competitive price. Sellers who price competitively are much more likely to find a suitable buyer quickly before their home appears stale, and they can often then negotiate on price on any onward purchase.” Tim Bannister, Rightmove.

Current homeowners and prospective buyers may be reassured by June 23rd’s meeting between Chancellor Jeremy Hunt, the UK’s principal mortgage lenders and the Financial Conduct Authority (FCA). They agreed a support plan for those struggling with mortgage repayments, although latest market indicators (FCA; UK Finance) show that mortgage arrears and defaults remain below pre-pandemic levels. The Treasury also added that the proportion of disposable income spent on mortgage payments is currently 5.4%, compared to c.10% in the 1990s.

The lenders, who represent over 75% of the market, agreed to a new charter providing support for two groups of people; those at risk of losing their home if they fall behind in their mortgage payments, and those worrying about higher mortgage rates when their current fixed rate mortgage comes to an end.

The charter offers reassurance on three key points. Firstly, anyone can talk to their lender without impacting their credit score. Secondly, if you change your mortgage to interest only or extend the term of your mortgage and you want to go back to your original mortgage deal within six months, you can do so, no questions asked and no impact on your credit score. Thirdly, in the extreme situation where lenders need to repossess a home, they have agreed to a minimum 12-month period before repossession without consent. Nikhil Rathi, chief executive of the Financial Conduct Authority, added: “The productive meeting builds on the work we’ve done over the last year to ensure those who get into difficulty receive the tailored support they need. We’ll move quickly to make any changes needed to support today’s commitments.”

The lettings market in our network area remains extremely buoyant with the number of prospective tenants far outnumbering the properties that are available. We have seen 10-15% increases in rents over the last 12 months and rents are still increasing, although at a slower rate due to affordability as many tenants cannot afford “out of kilter” rent increases on top of the current cost of living crisis.

However, with wage increases in recent months, we could again see rental values pushing upwards, supported by a lack of available properties to rent. We see the private rental sector market remaining buoyant throughout 2023 and landlords having no difficulty in letting their properties.

Currently, private rental properties must have a minimum energy efficiency rating of “E”, with exemptions for those properties where it would cost more than £3,500 to retrofit to this level, or for listed/protected properties. From 2025, government legislation requires any newly rented properties to have a rating of “C” or above, and any existing tenancies will have until 2028 to do the same. These changes are to ensure energy-efficient homes meet the government net-zero carbon targets. It is expected that the Government will announce similar exemptions for the new enhanced level, but with the additional cost involved to go from an EPC of E to C. Thus far, the government has not confirmed the exemption level. Immense pressure is being placed on the government to reduce the required rating level to “D” and to announce as early as possible what grants will be available for landlords towards the retrofitting required to meet the new standards.

Even if the Government delays the proposed deadline to 2028 for all rental properties, it does not leave long to find the money needed for the upgrades. There clearly needs to be more advice, guidance, and help for landlords and The Frost Partnership, along with most other agents, will continue to lobby the government in this regard.

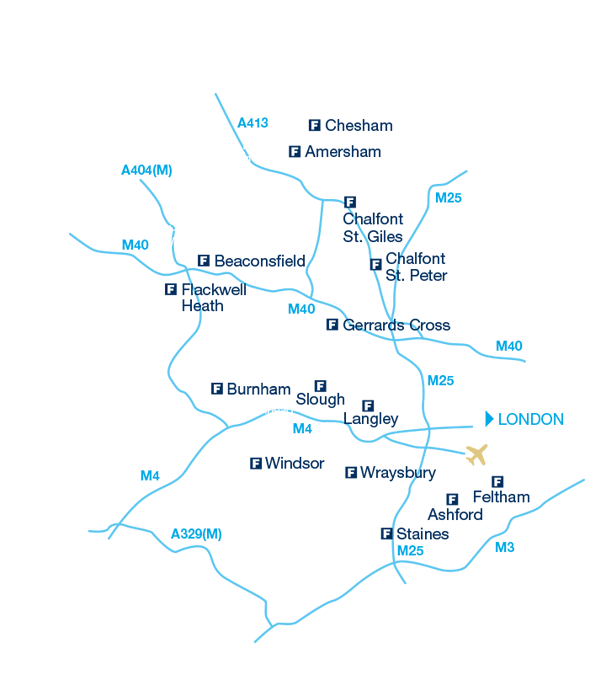

For more information on all property matters and professional sales and lettings advice, please contact your local Frost office.