Blog

Brexit – two weeks on

Friday, July 8, 2016

As the dust starts to settle two weeks after the UK’s referendum vote to leave the EU, there is still perhaps only one thing that can be said with any degree of certainty - that it has been a monumental fortnight in UK politics. After the shockwave of the referendum result, by and large the nation is trying to adjust and return to normal, whatever that may turn out to be. But attempts to restore calm have not been helped by media speculation, widespread outrage on social media and upheaval in both the Labour and Conservative parties, including the resignation of David Cameron as prime minister.

So what exactly does Brexit mean for the local property market? There’s a lot to suggest that the long term outlook is still very positive. Strong demand and a shortage of supply across both residential sales and lettings will ensure that property remains a solid option.House prices are unlikely to tumble while the market remains under-pinned by a lack of supply.The financial institutions have ample arrangements in place for mortgage lending and intense competition between lenders should see continued low mortgage rates keeping the market buoyant. With competitive lending, low interest rates and a shortage of supply, property remains an attractive proposition.

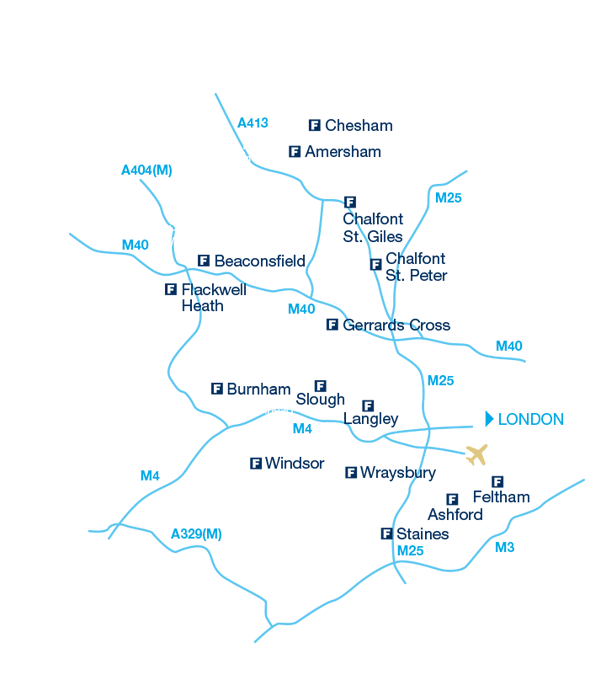

John Frost, Managing Director of The Frost Partnership, a network of 15 linked offices across Buckinghamshire, Berkshire and Middlesex, said that “across our network, whilst one or two sales fell through on Friday 24th, there are many more that exchanged or have subsequently been agreed. Frosts is an independent, family run company and is well placed to adapt to changing market conditions. With the referendum result out in the open, there may be challenges ahead but buyers and investors now know which way the nation is heading and no longer need to wait and see. We confidently expect prices to remain steady and continue to rise gradually during 2017 in line with inflation.”

There are many variables in play across the economy as a whole, but much depends on the nation’s leadership, its resilience and ability to accept the referendum result and make the most of it, moving forward with confidence in the UK’s ability to adapt and develop new trading relationships for the long term.In reality, it’s still too early to predict what will happen in the residential property industry but we do know the fundamentals of a lack of supply of housing and high demand have not changed.