Blog

Top tips for landlords for 2016

Thursday, January 28, 2016

With an ever increasing burden of legislation for landlords, tax changes and new health and safety regulations coming in, we look ahead at the coming year with five top tips for every landlord in 2016.

1 Have a spring clean of your admin paperwork. There’s a great deal of paperwork involved in owning and letting a property so make sure everything is filed securely and easy to access should you need it. Financial statements and original purchase documentation such as completion statements, evidence of legal and agent fees and other associated costs should all be kept, for the duration of ownership of the property. It may well enable you to reduce your tax liability too!

2 Make sure your tax affairs are in order - complete your self-assessment tax return before the 31st January deadline if you haven’t already done it. Read up on the forthcoming tax changes and plan ahead for any that affect you. Seek expert advice to ensure you are as tax efficient as possible whilst keeping on top of your liabilities.

3 Present your property at its best to maximise its potential rental return. Well maintained properties attract quality tenants, command a premium and require less maintenance. A few simple, inexpensive home improvements can widen your property’s appeal thereby maximising your return. Ask your local lettings agent for advice on what improvements will make the most difference to your bottom line. From April 2016 the ‘wear and tear allowance’ will be changed to a new system. Previously, landlords were able to claim wear and tear allowance as a matter of course. The new allowance only enables landlords to claim tax relief for costs actually incurred in replacing furnishings in the property. The good news is that this is available to all landlords, whether letting a furnished or unfurnished property.

4 Stay ahead of the game with legislation- many new regulations were announced in 2015 for landlords and there’s more to come! Right to Rent regulations come into force on February 1st and any landlords housing tenants that do not supply valid documents to meet the requirements of the Immigration Act 2014, face fines of up to £3,000 per tenant. From 1st April tenants can request consent from their landlords to carry out energy efficiency improvements to privately rented properties. The landlord may not unreasonably refuse consent and from April 2018 there will also be a requirement for private rental properties to have a minimum rating of “E” on an Energy Performance Certificate (EPC). Make sure you are up to date and complying with all relevant health and safety legislation if you are responsible for managing your property. And if you are using an agent to manage your property, checking that they have procedures in place to comply with the new regulations.

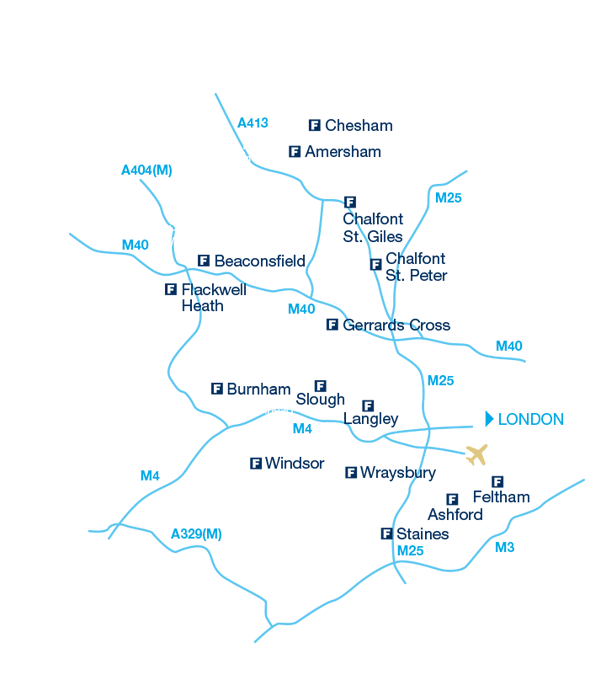

5 In spite of legal and tax changes, buy to let remains an attractive investment with a significant return over the medium – long term. Whether you are looking to achieve a good monthly rental return, capital growth on your investment or both, there are opportunities for investors to capitalise on strong demand for rental properties and increasing rental prices. Talk to your local Frost office for advice on where to achieve the best returns and how best to market and manage your property.