Blog

Good news for borrowers as base rate avoids increase.

Thursday, September 21, 2023

News today that the base interest rate is to remain at 5.25% will be good news for prospective homebuyers and for those with mortgages whose rates are not fixed. Today’s decision not to increase the base interest rate was prompted by a fall in inflation from 6.8% in July to 6.7%. However, even before today’s announcement, several high street lenders had been reducing rates on both residential and Buy To Let mortgage products, following a recent steady decline in swap rates and the need to remain competitive within the mortgage market.

Nathan Emerson, CEO at Propertymark, says: “It’s positive to see that the bank rate has remained unchanged this time around and will be reassuring for those looking to enter the housing market especially.”

Positive news about inflation figures and the decision to keep the base rate at 5.25% should enable lenders to make further cuts to mortgage rates in the coming weeks. And, if interest rates have now peaked, The Bank’s decision will also be very welcome news for some 1.5 million households who are approaching the end of their current fixed rate mortgage.

Jason Tebb, OnTheMarket’s CEO, commented: “The Bank of England’s decision not to raise interest rates will be welcomed by borrowers hoping that base rate has now peaked after many months of increases. It is hoped that this pause will give buyers and sellers, who had put plans on hold, more confidence to transact.”

Matt Smith, Head of Product (Mortgages) at Rightmove, said: “The surprising decision to hold rates rather than raise them as expected is another indication that we may now be at the peak of base rate rises. Today’s decision to pause rates is positive news for prospective home movers, and it is likely that lenders will continue to reduce rates, as we’ve seen over the last eight weeks, and we may see the pace of reductions increase in the coming weeks.”

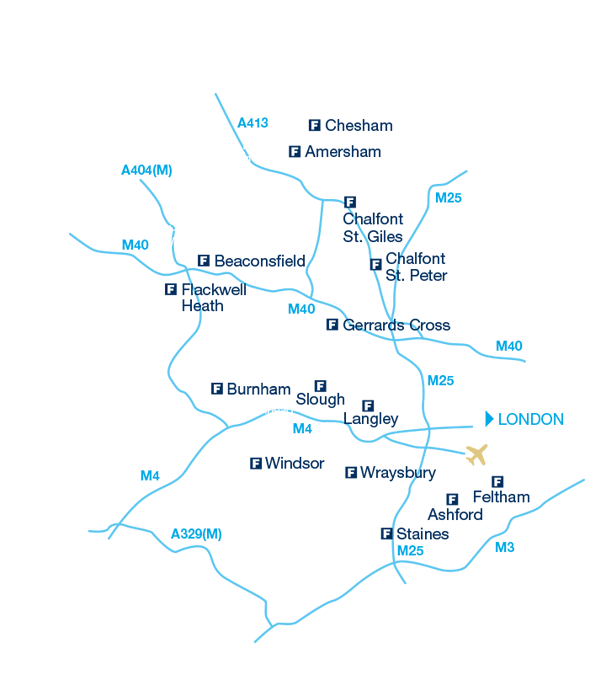

For more professional advice and information on the news from your local property market please contact your local Frost office.